Saving Money Every Month: 4 Easy Ways

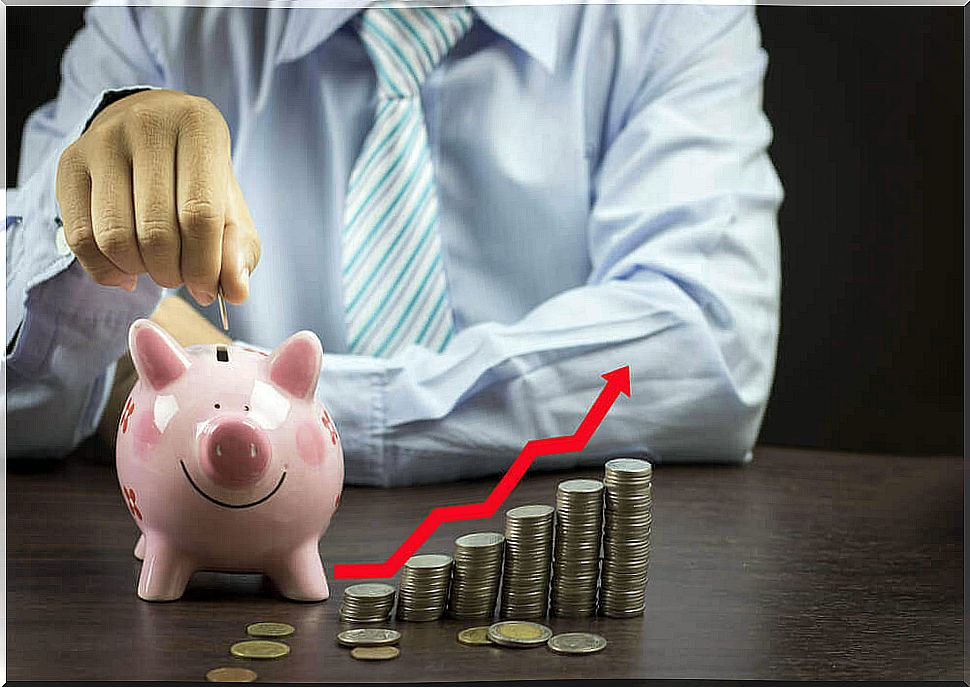

They say that saving is the path to wealth and it is absolutely true. Having a safety net can help us cope with bad financial times. Saving money every month is possible and we will discuss how you can do it in this article. And later you can apply it however you want!

Why saving money every month is a good idea

It is important to always set aside some money to help you in an emergency, for a good business opportunity, or for additional expenses.

Many people live from day to day and are a month away from bankruptcy if they lose their jobs (not counting any compensation they might get).

Not everyone makes a habit of saving. Worse, they don’t even know about its benefits.

At any moment something can happen that you did not foresee that requires cash. How would you deal with that if you only have debt and credit cards that have already reached the limit?

Plus, saving money every month is synonymous with planning for the future. Maybe you are someone who ‘lives in the now’.

However, you have to keep in mind that while things are going well now, things could be a very different story tomorrow. So you should always be prepared.

By that we don’t mean that you should stop enjoying things. What we do mean is that extra and unnecessary spending should be the exception rather than the norm.

There are many expenses that affect our ability to save. For example, think of:

- holidays

- to go out for dinner

- weekend getaways

- clothing

We also often spend a lot during sales, when there are many discounts in our favorite stores, or when we are bored.

To avoid reaching the point where you have to cut spending due to external factors (for example, price increases in fixed costs), it’s a good idea to set aside some money every month.

Tips to save money

On the one hand, it’s about being more organized or smarter, and on the other, it’s about letting go of certain “indulgence” that we buy to fill a hole or make us happy for a short time.

Cutting back on clothes, shoes, or going out can really help save money. Below are some other recommendations.

1. Record your expenses

One of the best ways to save money is to be aware of your spending habits.

You can do this by writing down everything you spend money on for a month. After shopping or paying bills, write it down in a notepad or in an Excel spreadsheet.

Make sure your notes are detailed so you can see exactly where most of your money is going:

- coffee on the way to work

- lunch at the office

- hand lotion

- a taxi ride

Once you’ve identified where you’re spending your money, you can eliminate unnecessary expenses. You can make coffee at home or take it with you in a special cup. You can also, for example, prepare your lunch a day in advance instead of buying it at the office.

2. Set a budget

If you are going to do the groceries and pay the bills at home, you should know approximately how much you need each month. Take all your fixed expenses into account and do not spend more than the maximum allowed.

Of course there may be changes. For example, if your electricity bill has gone up, you can reduce your power consumption by using the lights less often or doing the laundry only once a week.

A budget helps us in many ways because it shows us how much we spend and gives us a limit on how much we can spend.

Add up how much you spend on food, transportation and utilities – the three pillars of household spending.

3. Put money aside

One of the biggest mistakes people make when trying to save money is paying all their bills and expenses first and then putting some aside if there’s anything left. Usually, however, this strategy leaves little to set aside.

It is recommended that you save about 10% of your salary. You also have to make sure that it ends up in the right place (in the safe, under your mattress, or in investments, for example). However, it should be set aside once you receive it.

Something else: determine in which situations or purchases you can withdraw money from your savings. For example, medical emergencies, car problems, doctor visits, etc.

Saving money every month means not spending it on anything and everything. Otherwise you can never have enough.

4. Cut your expenses and debts

This saving step is critical to improving your finances and planning for your future.

As a first step, we recommend that you stop paying the minimum amount on your credit card and try to continue to pay off your personal loans. In this way you prevent yourself from incurring even more debts due to interest and fines.

Second, it is very important that you reduce your monthly expenses.

Do you eat out every weekend? Then only go out once a month. Do you buy new clothes every time you get paid? Only buy clothes for special occasions, for example for your birthday. Do you travel every holiday? You may also need to stay at home once in a while.

In this way, your finances will become a bit more ‘calm’ and you can save money every month.